Short Answer

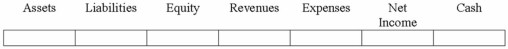

The Byer Company purchased the Cellar Company for $550,000 cash. Cellar's assets had been appraised at $560,000. At the time of sale Cellar's accounting records showed total assets of $490,000, liabilities of $80,000 and equity of $410,000. How would the purchase affect Byer's financial statements?

Correct Answer:

Verified

(I) (I) (N) (N) (N) (N) (D)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: Tangible assets include land,equipment,and goodwill.

Q28: An impairment of an intangible asset reduces

Q29: Name three examples of property,plant and equipment.

Q79: Explain the meaning of the terms "tangible"

Q135: Clarkson Company paid cash to purchase equipment

Q136: Which of the following terms is used

Q137: On January 1, 2013 Ballard Company spent

Q142: On March 1, Bunker Hill Company purchased

Q144: Assume that Wu Company earned $15,000 cash

Q145: Which of the following correctly shows the