Essay

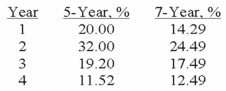

The Garcia Corporation purchased $40,000 of equipment on July 1, 2013. The equipment is expected to be used in the business for five years and has an estimated salvage value of $5,500. Partial MACRS tables are listed below:  Required:

Required:

a) Compute the amount of depreciation that is deductible under MACRS for 2013 and 2014 assuming that the equipment is classified as 5-year property.

b) Compute the amount of depreciation that is deductible under MACRS for 2013 and 2014 assuming that the equipment is classified as 7-year property.

Correct Answer:

Verified

a) Five-Year Property:

2013 $8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2013 $8...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: On January 1, 2013, Fritz Company purchased

Q22: Which of the following statements is true

Q23: Which of the following terms is used

Q24: Assume that Bybee uses the units of

Q26: The Rollins Company purchased a delivery van

Q27: Chesapeake Company paid $475,000 for a basket

Q28: On January 1, 2013, the City Taxi

Q30: The Bugs Company purchased the Daffy Company

Q47: A trademark is a tangible asset with

Q74: Explain the meaning of "impairment" as used