Essay

On January 1, 2013, the Daley Corporation paid $9,000 for major improvements on a two-year-old manufacturing machine. Although the expenditure did not change the expected useful life, it greatly increased the productivity of the machine. Prior to this transaction, the machine account in the general ledger was listed at $42,000, and the accumulated depreciation account was $10,000. Daley uses the straight-line depreciation method. The estimated useful life was six years, and the estimated salvage value was $2,000.

Required:

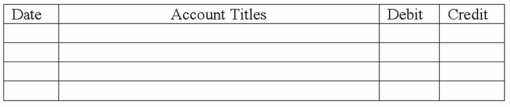

a) Prepare the entry in general journal form for the January 1, 2013 transaction.  b) Immediately after the January 1, 2013 transaction, what is the book value of the asset on Daley books?

b) Immediately after the January 1, 2013 transaction, what is the book value of the asset on Daley books?

c) Compute the depreciation for the machine for December 31, 2013.

Correct Answer:

Verified

a) General journal entry for the January...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: What is the name of the tax

Q39: An expenditure that improves the quality of

Q57: Recognizing depreciation expense on equipment or a

Q67: Give an example of a type of

Q72: The Grant Company purchased the Lee Company

Q74: On January 1, 2013 Dungan Company purchased

Q77: In 2013, Rocky Mountain Mining Co. purchased

Q78: For 2013, The Oscar Company records depreciation

Q79: Leland Co. paid $400,000 for a purchase

Q80: In January 2013, Rogers Co. purchased a