Essay

Torres Company established a petty cash fund for $300 on January 1, 2013. At the end of the month, the petty cash fund contained cash of $37.60 and vouchers for the following cash payments: freight on goods shipped to customers, $68.00; postage, $74.00; miscellaneous expense, $80.22; entertainment expense, $36.00.

Three distinct events affected the petty cash fund during January:

1. establishment of the fund;

2. making payments for various items from the fund; and

3. recognizing expenses and replenishing the fund at the end of the month

Required:

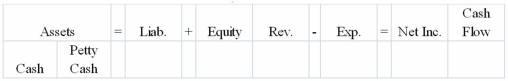

a) Record each of the events in the horizontal statements model below. Indicate with the dollar amount of the increase or decrease, or NA if the element is not affected.  b) Prepare journal entries for these events.

b) Prepare journal entries for these events.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: On May 1, 2013, Cook Company established

Q3: Which of the following is not a

Q4: Indicate whether each of the following statements

Q5: Which of the following is not an

Q6: Which of the item(s) would be subtracted

Q10: On September 30, 2013, the bank statement

Q12: Indicate whether each of the following statements

Q92: For internal control purposes,what is meant by

Q127: Separation of duties in an organization should

Q140: Even a good system of internal controls