Multiple Choice

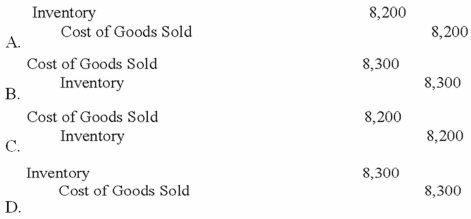

Torres Company purchased 2,000 units of inventory that cost $2.00 each on January 1, 2013. An additional 3,000 units of inventory were purchased on January 12, 2013 at a cost of $2.10 each. Torres Company sold 4,000 units of inventory on January 20, 2013. Which of the following entries would be required to recognize the cost of goods sold assuming that Torres Co. uses the perpetual inventory method and a FIFO cost flow method?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Define the terms FIFO and LIFO.

Q74: Indicate whether each of the following statements

Q76: Wooster Company purchased two units of a

Q77: Greene's ending inventory under weighted average would

Q80: Kenya Co. uses the perpetual inventory method.

Q81: Cho Co. sells product<br>A. The beginning inventory

Q82: The following information is for Blakemore Company

Q83: Bowden Company paid cash to purchase two

Q84: Zeus Company understated its ending inventory. Which

Q119: What is meant by "market" in lower-of-cost-or-market