Short Answer

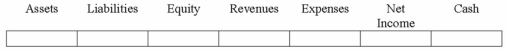

Gannon, Inc. applies the lower-of-cost-or-market rule to its inventory in aggregate. At the end of the accounting period, it is determined that the cost of the inventory is $25,985 and the market (replacement) value is $24,886. If an adjustment is necessary, what is its effect on the financial statements?

Correct Answer:

Verified

(D) (N) (D) (N) (I) (D) (N)

Explanation:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Explanation:...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: What ratio (usually an average from prior

Q13: The specific identification inventory method is not

Q21: During November 2013, Cortez Company sold 125

Q22: One of the disadvantages of the specific

Q26: The average number of days to sell

Q27: Assume that Pufferbellies Bookstore purchased the first

Q28: Which of the following methods of applying

Q30: If Beamon Company is using LIFO, how

Q61: If a company uses the FIFO cost

Q118: Explain the effects of an understatement of