Essay

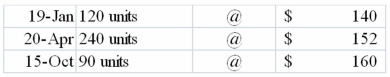

Mandela Company's first year in operation was 2013. The following inventory information comes from Mandela's accounting records for the year.  During the year, Mandela sold 350 units for $240 each. Operating expenses for the year were $15,000, and the tax rate was 30%.

During the year, Mandela sold 350 units for $240 each. Operating expenses for the year were $15,000, and the tax rate was 30%.

Required:

a) Calculate the cost of goods sold by LIFO and by FIFO.

b) What amount of income tax would Mandela have to pay if it uses LIFO? If it uses FIFO?

c) Assuming that the results for 2013 are representative of what Mandela can generally expect, would you recommend that the company use LIFO or FIFO? Explain.

Correct Answer:

Verified

a) For LIFO, cost of goods sold = (90 × ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: The Internal Revenue Service allows a company

Q132: Wu Company sold 150 units @ $350

Q133: An error that results in overstating ending

Q134: The last-in, first-out cost flow method assigns

Q136: Determine the weighted average cost per unit

Q137: When using the gross margin method to

Q138: Company A and Company B are similar

Q139: Greene's ending inventory under LIFO would be:<br>A)$910.<br>B)$820.<br>C)$740.<br>D)$650.

Q141: The Bristol Company was recently required to

Q142: Why are the inventory and cost of