Essay

Jenkins Company sells home weather exercise bikes. Its beginning inventory was 50 units at $200 per unit. During the year, Jenkins made two purchases of the bikes: first, a 150-unit purchase at $220 per unit, and then 100 units at $250 per unit. The ending inventory for the year was 125 units.

Required:

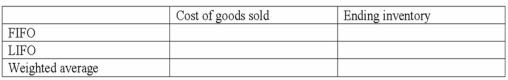

Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Jenkins uses

a) FIFO

b) LIFO

c) Weighted average

Correct Answer:

Verified

Correct Answer:

Verified

Q54: What are the circumstances that might cause

Q63: Which inventory costing method will produce an

Q64: The Atkins Company had the following beginning

Q65: If Singh uses the LIFO cost flow

Q66: Kitchen Company uses the perpetual inventory method.

Q67: Which of the following statements is correct

Q70: How would the sale affect the financial

Q71: Wynn Corporation's 2013 ending inventory was overstated

Q73: King Camera Shop applies the lower-of-cost-or-market rule

Q81: In an inflationary period,which cost flow method,LIFO