Essay

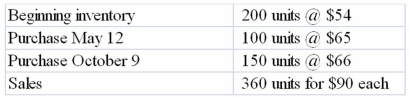

The following information is for Pelham Company for 2013  Required:

Required:

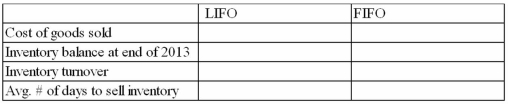

a) Assuming that Pelham uses the LIFO cost flow method, determine how much product cost would be allocated to Cost of Goods Sold, and how much to Merchandise Inventory at the end of the year.

b) Based on your results from part a, calculate inventory turnover and average number of days to sell inventory.

c) Assuming that Pelham uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to Merchandise Inventory at the end of the year.

d) Based on your results from part c, calculate inventory turnover and average number of days to sell inventory.

e) Compare your results from parts b and d. Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Correct Answer:

Verified

a) - d)  e) LIFO and FIFO do not give th...

e) LIFO and FIFO do not give th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: If a company applies the lower-of-cost-or-market rule

Q4: If a firm is using the lower-of-cost-or-market

Q5: The lower-of-cost-or-market rule can be applied to<br>A)major

Q6: Maddox Company uses the perpetual inventory method.

Q7: Sandridge Company uses the weighted average inventory

Q10: The Darden Company had its entire inventory

Q12: Which of the following circumstances is not

Q60: In most businesses,the physical flow of goods

Q60: Explain the computation of the inventory amount

Q77: International Financial Reporting Standards (IFRS)do not permit