Essay

The following transactions apply to Kent Company.

1) Issued common stock for $21,000 cash

2) Provided services to customers for $28,000 on account

3) Purchased land for $18,000 cash

4) Incurred $9,000 of operating expenses on account

5) Collected $15,000 cash from customers for services provided in event #2

6) Paid $7,000 on accounts payable

7) Paid $2,500 dividends to stockholders

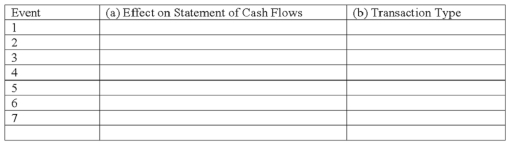

Required:

a) Identify the effect on the Statement of Cash Flows, if any, for each of the above transactions. Indicate whether each transaction involves operating, investing, or financing activities and the amount of increase or decrease.

b) Classify the above accounting events into one of four types of transactions (asset source, asset use, asset exchange, claims exchange).

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Discuss the importance of ethics in the

Q52: Recognition of depreciation expense on equipment decreases

Q79: The term "recognition" means to report an

Q93: Thiessen Company started its business by issuing

Q95: The amount of net income shown on

Q96: Tuttle Company shows the following transactions for

Q99: Total assets on the December 31, 2013

Q100: In a company's annual report, the reader

Q101: Providing services to customers on account is

Q102: Adkins Company experienced an accounting event that