Essay

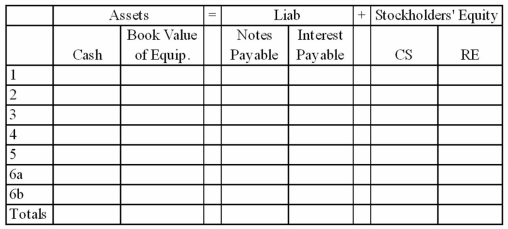

The following events apply to John's Lawn Service for 2013.

1). Issued stock for $14,000 cash.

2). On January 1, purchased equipment for $12,000. The equipment has an estimated 5-year useful life and a $2,000 salvage value.

3). On May 1, issued a $3,000, 5% 3-year note to a local bank.

4). Performed services of $18,400 and received cash.

5). Paid $15,000 of operating expenses.

6). At December 31, adjusted the records to recognize expense associated with use of the equipment and accrued interest.

Required:

Record the effects of the above events under the appropriate account headings in the accounting formula below.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: The collection of an account receivable is

Q76: Grant Company purchased a machine on January

Q77: Record each of the following events in

Q78: Jerry Mathers started his business by issuing

Q79: Revenue on account amounted to $4,000. Cash

Q80: The following events apply to Bowen's Cleaning

Q82: Which of the following is not a

Q83: Which of the following correctly states the

Q84: The amount of retained earnings as of

Q86: Thornrose Company started its business on January