Essay

The transactions listed below apply to Lovell Company for its first year in business. Assume that all transactions involve the receipt or payment of cash.

Transactions for the year 2012:

1) Issued common stock to investors for $15,000 cash.

2) Borrowed $8,000 from the local bank.

3) Provided services to customers for $18,000.

4) Paid expenses amounting to $11,400.

5) Purchased a plot of land costing $12,000.

6) Paid a dividend of $6,000 to its stockholders.

7) Repaid $4,000 of the loan listed in item 2.

Required:

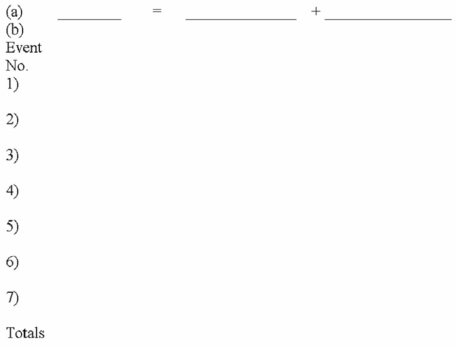

(a) Fill in the headings to the accounting equation shown below.

(b) Show the effects of the above transactions on the accounting equation

Correct Answer:

Verified

Correct Answer:

Verified

Q37: An asset exchange transaction does not affect

Q38: Indicate how each of the following transactions

Q39: Which of the following is NOT an

Q41: Walsh Co. paid a $50,000 cash dividend

Q43: If the total equity claimed by owners

Q45: "IASB" stands for<br>A)Internal Accounting Standards Board<br>B)Internationally Authorized

Q46: Falcon Company earned $15,000 of cash revenue.

Q47: Richardson Company paid $850 cash for rent

Q70: How does providing services for cash affect

Q106: Briefly distinguish between financial accounting and managerial