Not Answered

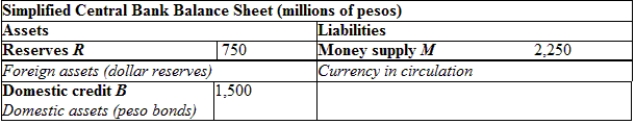

(Table: Mexico's Central Bank Balance Sheet) Suppose foreign interest rates rise in the United States, causing money demand to change by 150 million pesos. What will happen to reserves, domestic credit, and the backing ratio? Explain how these changes take place.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q27: Typically, an exchange rate crisis can be

Q28: When the central bank offsets a fall

Q29: Saudi Arabia pegs its currency (the riyal,

Q30: What are the three types of crises

Q31: Argentina could reduce the supply of money

Q33: Saudi Arabia pegs its currency (the riyal,

Q34: Which of the following occurs during a

Q35: Because of a rise in its risk

Q36: Although fixed exchange rates are desirable for

Q37: If the price level is fixed, the