Multiple Choice

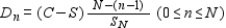

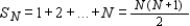

One of the methods that the Internal Revenue Service allows for computing depreciation of certain business property is the sum-of-the-years'-digits method. If a property valued at C dollars has an estimated useful life of N years and a salvage value of S dollars, then the amount of depreciation Dn allowed during the nth year is given by  where SN is the sum of the first N positive integers representing the estimated useful life of the property. Thus,

where SN is the sum of the first N positive integers representing the estimated useful life of the property. Thus,  If office furniture worth $7,300 is to be depreciated by this method over N = 11 years and the salvage value of the furniture is $700, find the depreciation for the third year by computing D3 .

If office furniture worth $7,300 is to be depreciated by this method over N = 11 years and the salvage value of the furniture is $700, find the depreciation for the third year by computing D3 .

A) $2,700

B) $900

C) $700

D) $450

Correct Answer:

Verified

Correct Answer:

Verified

Q142: Find the present value of the ordinary

Q143: Determine whether the statement is true or

Q144: A printing machine that has an estimated

Q145: Find the amount of an ordinary annuity

Q146: Find the first five, terms of the

Q148: Carl is the beneficiary of a $24,000

Q149: Find the 20th term and sum of

Q150: Find the amount (future value) of the

Q151: Investment A offers a 9% return compounded

Q152: If a merchant deposits $2,000 annually at