Multiple Choice

Formulate but do not solve the problem.

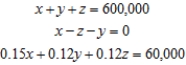

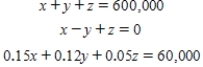

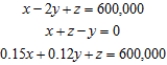

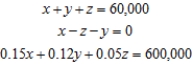

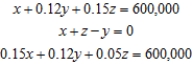

A private investment club has $600,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low risk. Management estimates that high-risk stocks will have a rate of return of 15%/year; medium-risk stocks, 12%/year; and low risk stocks, 5%/year. The members have decides that the investment in medium-risk stocks should be equal to the sum of the investments in the stocks of the other two categories. Determine how much the club should invest in each type of stock if the investment goal is to have a return of $60,000/year on the total investment. (Assume that all the money available for investment is invested) . Let x be the amount of money invested in high-risk stocks, y be the amount of money invested in medium-risk stocks, and z be the amount of money invested in low-risk stocks.

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q142: Formulate but do not solve the problem.

Q143: Find the transpose of the given matrix.

Q144: Formulate but do not solve the problem.

Q145: Compute the product.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6027/.jpg" alt="Compute the

Q146: Matrix A is an input-output matrix associated

Q148: Indicate whether the matrix is in row-reduced

Q149: Company TKK Corporation, a large conglomerate, has

Q150: The manegement of Hartman Rent-A-Car has allocated

Q151: Solve the system of linear equations using

Q152: Matrix A is an input-output matrix associated