Short Answer

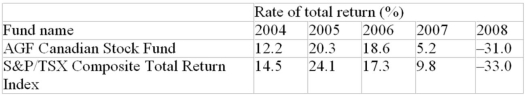

The following table presents the rates of total return in successive years from 2004 to 2008 for the AGF Canadian Stock Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Correct Answer:

Verified

Correct Answer:

Verified

Q30: An investor purchased preferred shares on the

Q45: On overdue accounts the telephone company charges

Q108: An investor's portfolio increased in value from

Q234: An effective rate of 11.4% has a

Q246: The current (simple annualized) yield on a

Q285: The Canadian Consumer Price Index (based on

Q298: A stock valued at $150 increased by

Q311: Calculate the equivalent interest rate (to the

Q313: If an invoice indicates that interest at

Q313: Calculate the equivalent interest rate (to the