Short Answer

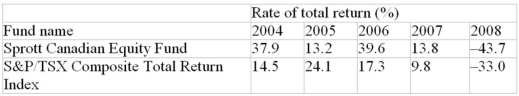

The following table presents the rates of total return in successive years from 2004 to 2008 for the Sprott Canadian Equity Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Correct Answer:

Verified

Correct Answer:

Verified

Q14: From a lender's point of view, would

Q78: A credit union pays 5.25% compounded annually

Q143: A portfolio earned annual rates of 18%,

Q168: Many department stores charge 2.4% per month

Q201: What rate of return in the second

Q223: A $25,000 strip bond is purchased for

Q252: For an investment to double in value

Q253: Calculate the equivalent interest rate (to the

Q260: Calculate the missing interest rate (to the

Q323: A $5,000 investment was purchased for $4220.50.