Short Answer

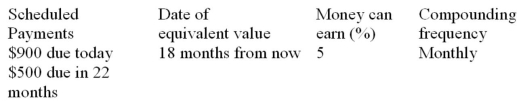

Calculate the combined equivalent value of the scheduled payments on the indicated dates. The rate of return that money can earn is given in the fourth column. Assume that payments due in the past have not yet been made.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Calculate the maturity value of a five-year,

Q74: If a quantity declines by x% per

Q75: How much money was needed 15 years

Q78: Calculate the missing value: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4281/.jpg" alt="Calculate

Q80: Calculate the maturity value: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4281/.jpg" alt="Calculate

Q88: A $4,000 loan at 5% compounded monthly

Q155: Two payments of $2,000 each are scheduled

Q176: What single payment 1 year from now

Q222: Jack invested $10,000 at 10% compounded annually

Q239: Interest is 3.75% compounded monthly. If you