Related Questions

Q64: Sam has a $10,000 personal line of

Q153: Paul has $20,000 to invest for 6

Q154: The purchaser of a 168-day T-bill with

Q155: An $8,000 demand loan at a fixed

Q156: On February 22, Jonathan had $20,000 of

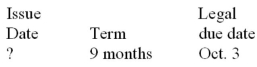

Q158: Calculate missing value for the promissory note:

Q159: For investments over $5,000, a bank quotes

Q160: An assignable loan contract executed 3 months

Q161: Suppose that the current rates on 90-and

Q162: Over the past 35 years, the prevailing