Multiple Choice

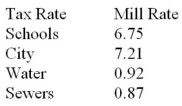

A homeowner's tax statement lists the following mill rates for various municipal services:  The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

A) $264,617

B) $265,509

C) $461,066

D) $250,000

E) $437,500

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Marilyn's gross pay last month was $3,300.00.

Q34: What is the percent Rate if a

Q111: The following fraction has a terminating decimal

Q119: One year ago, Ming allocated the funds

Q120: Evaluate <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4281/.jpg" alt="Evaluate A)

Q121: Evaluate the answer correct to the cent:

Q165: Evaluate the answer correct to the cent:

Q252: Through a calculation (on Canadian Individual Tax

Q307: The royalty rate performing artists receive from

Q311: A seasonal manufacturing operation began the calendar