Multiple Choice

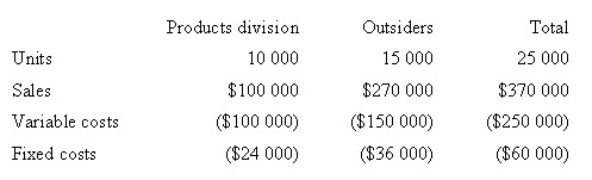

Corporate policy at Weber Pty Ltd requires that all transfers between divisions be recorded at variable cost as a transfer price.Divisional managers have complete autonomy in choosing their sources of customers and suppliers.The Milling Division sells a product called RK2.Forty per cent of the sales of RK2 are to the Products Division,while the remainder of the sales are to outside customers.The manager of the Milling Division is evaluating a special offer from an outside customer for 10 000 units of RK2 at a per unit price of $15.If the special offer were accepted,the Milling Division would be unable to supply those units to the Products Division.The Products Division could purchase those units from another supplier for $17 per unit.Annual capacity for the Milling Division is 25 000 units.The 2008 budget information for the Milling Division,based on full capacity,is presented below.Assume the company permits the division managers to negotiate a transfer price.The managers agree to a $15 transfer price adjusted to share equally the additional gross margin to Milling Division resulting from the sale to the Products Division.What is the agreed transfer price?

A) $14.00

B) $13.50

C) $12.50

D) $10.50

Correct Answer:

Verified

Correct Answer:

Verified

Q6: When responsibility centres are established as revenue

Q7: Which of the following is a benefit

Q9: Fragrance Pty Ltd has two divisions: the

Q19: Division A transfers a profitable subassembly to

Q22: Which of the following statements is/are false?<br>A)

Q24: Which of the following statements about transfer

Q25: The following information was taken from the

Q39: Nova Company has two divisions: OPA Division

Q50: Delegating decision making to lower-level managers, thereby

Q86: Hamilton has no excess capacity. If the