Multiple Choice

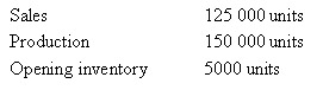

The Browning Company manufactures a single product;the standard costs per unit being variable manufacturing $8,fixed manufacturing $6.Selling and administrative costs are $2 per unit sold.The selling price is $20 per unit.Actual and budgeted fixed overhead is $900 000 for the year.Information about Browning's production activity for the year follows:

Assuming all information is provided above,the difference in profit between absorption and variable costing would be expected to be:

A) 25 000 × $8

B) 30 000 × $8

C) 25 000 × $6

D) 30 000 × $6

Correct Answer:

Verified

Correct Answer:

Verified

Q2: For management accounting purposes, the denominator volume

Q7: Using the information below,what would be the

Q26: Budgeted amounts of allocation bases, rather than

Q36: The most widely used methods of support

Q47: The 'direct method' ignores the fact that:<br>A)

Q51: Prior to allocating overheads to a product,

Q68: Before any costing process can occur, it

Q71: The step/s used in cost allocation include/s:<br>A)

Q89: Management would prefer to use either absorption

Q95: A cost pool is:<br>A) a collection of