Essay

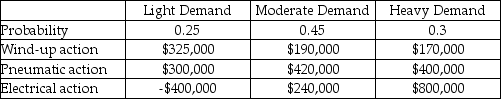

A toy manufacturer has three different mechanisms that can be installed in a doll that it sells.The different mechanisms have three different setup costs (overheads)and variable costs and,therefore,the profit from the dolls is dependent on the volume of sales.The anticipated payoffs are as follows.

a.What is the EMV of each decision alternative?

a.What is the EMV of each decision alternative?

b.Which action should be selected?

c.What is the expected value with perfect information?

d.What is the expected value of perfect information?

Correct Answer:

Verified

(a)Wind-up = .25($325,000)+ .45($190,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: If a decision maker knows for sure

Q36: Define expected monetary value (EMV).

Q40: Which decision rule under uncertainty results in

Q70: An example of expected monetary value would

Q82: Daily sales of bread by Salvador Monella's

Q84: The maximax criterion of decision making requires

Q85: Massive amounts of data:<br>A)are often collected in

Q86: A retailer is deciding how many units

Q90: What is the expected value with perfect

Q91: Miles is considering buying a new pickup