Multiple Choice

Figure 4-21

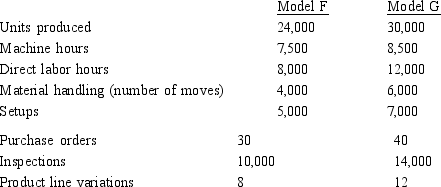

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

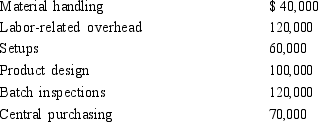

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

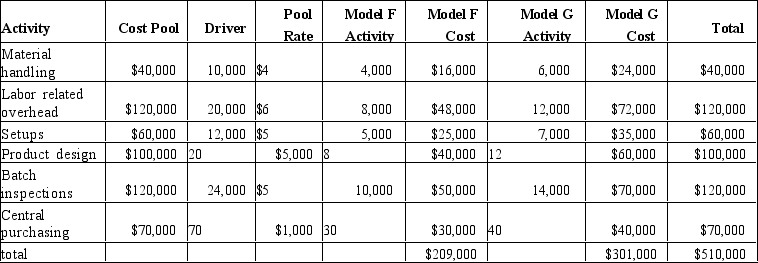

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under this new approach, which two activities would be selected as the cost pools?

A) materials handling and labor related

B) labor related and batch inspections

C) product design and batch inspections

D) materials handling and central purchasing

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Figure 4-6<br>The Fast & Furious Company produces

Q16: Figure 4-17<br>X-TREME Corporation has the following activities:

Q17: Figure 4-11<br>Longview Manufacturing Company manufactures two products

Q33: The simple list of activities identified in

Q42: Using the before-the-fact simplification method TDABC eliminates

Q46: If activity-based costing is used, setups would

Q89: More accurate product costing information is produced

Q125: Products might consume overhead in different proportions

Q132: After-the-fact simplification includes two approaches: the approximately

Q183: If activity-based costing is used, electricity usage