Multiple Choice

Figure 4-21

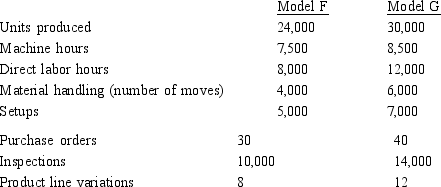

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

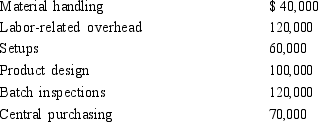

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

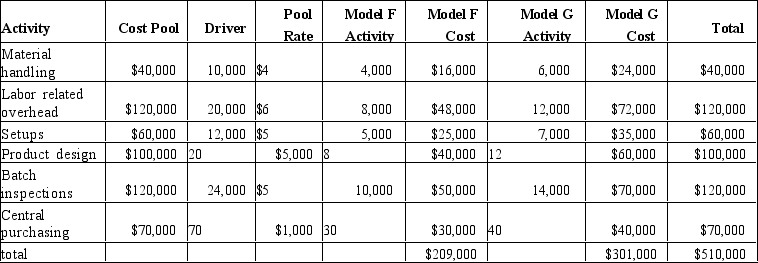

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under this new approach using the new rates, what are the overhead costs assigned to Model G in this approximately relevant ABC system?

A) $120,000

B) $208,250

C) $255,000

D) $301,750

Correct Answer:

Verified

Correct Answer:

Verified

Q36: The justification for not using a departmental

Q95: Figure 4-20<br>Quasi-Tech Corporation produces specially machined parts.

Q96: Figure 4-6<br>The Fast & Furious Company produces

Q97: Figure 4-4<br>Mannitou Company made the following predictions

Q99: Figure 4-16<br>Samson Company recently installed an activity-based

Q101: Figure 4-14<br>Lawson Manufacturing has four categories of

Q103: Figure 4-6<br>The Fast & Furious Company produces

Q105: Figure 4-21<br>Appleby Manufacturing uses an activity-based costing

Q172: In a department that is drilling holes

Q176: The first step in designing an activity-based