Multiple Choice

Figure 4-21

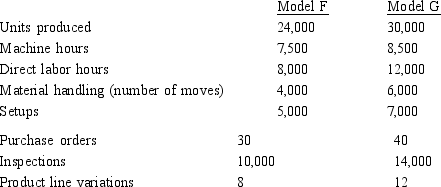

Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:

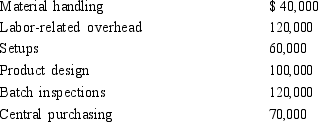

The following overhead costs are reported for the following activities of the production process:

The following overhead costs are reported for the following activities of the production process:

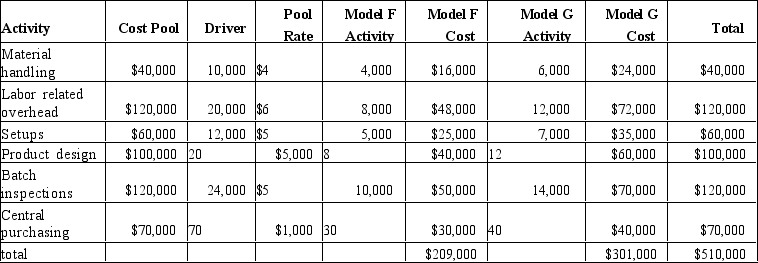

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

-Refer to Figure 4-21. Under equally accurate reduced ABC system, using consumption ratios for labor related and batch inspections, the overhead cost assigned to Model F would be? (round to 5 decimal places)

A) $204,000

B) $318,750

C) $306,000

D) $191,250

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Material amounts of underapplied or overapplied overhead

Q34: Product classification attributes define and describe activities

Q53: A predetermined overhead rate is calculated using

Q56: If activity-based costing is used, security is

Q69: The formula Budgeted annual overhead/Budgeted annual driver

Q81: Figure 4-16<br>Samson Company recently installed an activity-based

Q85: Figure 4-20<br>Quasi-Tech Corporation produces specially machined parts.

Q86: Refer to Figure 4-22. What is the

Q173: Motorsports, Inc. had a predetermined overhead rate

Q185: A(n) _ is a grouping of logically