Essay

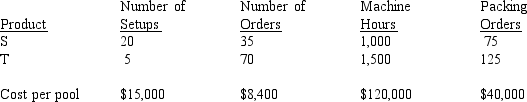

Tusker Corporation manufactures two products (S and T). The overhead costs have been divided into four cost pools that use the following activity drivers:

a. Compute the allocation rates for each of the activity drivers listed.

b. Allocate the overhead costs to Products S and T using activity-based costing.

c. Compute the overhead rate using machine hours under the functional-based costing system.

d. Allocate the overhead costs to Products S and T using the functional-based costing system overhead rate calculated in part (c).

Correct Answer:

Verified

c. ($15,000 + $8,400 + $120,0...

c. ($15,000 + $8,400 + $120,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: If activity-based costing is used, set-ups would

Q20: The use of _ activity drivers to

Q146: Unit-based product costing assigns manufacturing and selling

Q164: Bayview Manufacturing Company has an accounts receivable

Q165: Figure 4-21<br>Appleby Manufacturing uses an activity-based costing

Q168: Figure 4-21<br>Appleby Manufacturing uses an activity-based costing

Q168: All of the following are non-unit-based activity

Q169: The system that first traces costs to

Q171: Figure 4-10<br>The Manoli Company has collected the

Q172: Figure 4-20<br>Quasi-Tech Corporation produces specially machined parts.