Essay

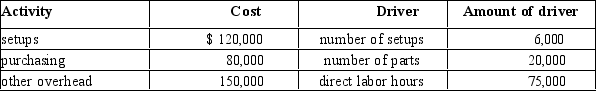

Lowland Corporation is a job order costing company that uses activity-based costing to apply overhead to jobs. The following overhead activities were budgeted for the year.

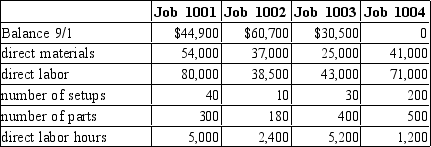

The following information about the jobs was given for September.

The following information about the jobs was given for September.

By September 30, Jobs 1001 and 1003 were completed and sold. The remaining jobs were still in process.

By September 30, Jobs 1001 and 1003 were completed and sold. The remaining jobs were still in process.

Required:

1. Calculate the activity rates for each overhead activity.

2. Calculate the cost of each job for September 30.

3. What is the beginning work in process on September 1 and October 1?

4. What is the cost of goods manufactured?

5. What is the cost of goods sold?

6. Draw the T account for work in process. (include all debits and credits) Prepare the Statement of the Cost of Goods Manufactured.

Correct Answer:

Verified

1.

2.

2.

3. BWIP = $136,100

EWIP 9/30 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

3. BWIP = $136,100

EWIP 9/30 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Under normal costing, which of the following

Q34: _ are the source of information for

Q51: Figure 5-9<br>The Omega Company manufactures customized motors

Q53: The following information was taken from the

Q54: Collossal Company uses a predetermined rate to

Q60: Figure 5 - 6<br>In the Monroe Company,

Q65: Manufacturers producing unique or customized products would

Q92: The _ costing system assigns costs by

Q96: Which of the following costing systems assigns

Q137: In a job-order costing system, if costs