Multiple Choice

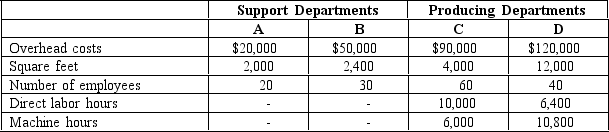

Rodriguez Manufacturing prices its products at full cost plus 40 percent. The company operates two support departments and two producing departments. Budgeted costs and normal activity levels are as follows:  Support Department A's costs are allocated based on square feet, and Support Department B's costs are allocated based on number of employees. Department C uses direct labor hours to assign overhead costs to products, while Department D uses machine hours.

Support Department A's costs are allocated based on square feet, and Support Department B's costs are allocated based on number of employees. Department C uses direct labor hours to assign overhead costs to products, while Department D uses machine hours.

One of the products the company produces requires 4 direct labor hours per unit in Department C and no time in Department D. Direct materials for the product cost $45 per unit, and direct labor is $20 per unit.

If the sequential method of allocation is used and the company follows its usual pricing policy, the selling price of the product would be (round service allocations to the nearest whole dollar and the costs per unit to two decimal places)

A) $113.52.

B) $159.38.

C) $108.46.

D) $162.52.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Activities or variables within a producing department

Q65: Figure 7-6<br>Golden Leaves Company has two support

Q66: Laredo Corporation, which manufactures products W, X,

Q67: A company incurred $80,000 of common fixed

Q68: The Savings Bank of Sarasota has three

Q69: Fixed support department costs should be allocated

Q72: A company incurred $120,000 of common fixed

Q73: A company incurred $40,000 of common fixed

Q80: Allocation is not necessary when using JIT

Q152: The split-off point can best be defined