Essay

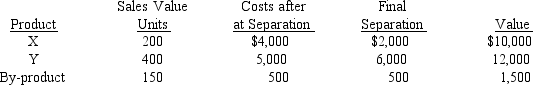

Mandala Inc. obtains two products and a by-product from its production process. By-product revenues are treated as other income and a noncost approach is used to assign costs to them. During the period, 1,200 units were processed at a cost of $12,000 for materials and conversion costs, resulting in the following:

Required:

Required:

a. Account for all costs using a physical basis for allocation.

b. Account for all costs using net realizable value as the basis for allocation.

c. Account for all costs using final sales value as the basis for allocation.

d. How much joint costs should be allocated to the by-product?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Which of the following would be the

Q23: Support departments<br>A)are responsible for manufacturing the products

Q28: Cumadin Corporation, which manufactures Products W, X,

Q28: The three methods of allocating support center

Q29: Figure 7-3<br>Hanover and Trust, a large law

Q77: Which of the following is a by-product?<br>A)lumber<br>B)fresh

Q120: Departmental overhead rate is computed by dividing

Q128: If a support department's costs were budgeted

Q157: If the allocation is for performance evaluation,

Q160: A possible causal factor to use when