Multiple Choice

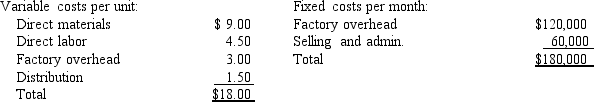

Hobart Company produces speakers for PA systems. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales

The variable distribution costs are for transportation to the retail music stores. The current production and sales

Volume is 20,000 per year. Capacity is 25,000 units per year.

A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit. If Hobart Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

A) decrease of $19,000

B) increase of $19,000

C) increase of $6,000

D) increase of $13,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Sound tactical decision making is limited to

Q21: Relevant costs are<br>A)past costs.<br>B)future costs.<br>C)full costs.<br>D)cost drivers.

Q25: In the activity resource model, flexible resources

Q43: The future costs that differ across alternatives

Q53: Hobart Company produces speakers for PA systems.

Q53: Noreaster Company produces a product that has

Q54: Which of the following would be TRUE?

Q55: Santa Lucia Industries employs 500 workers in

Q58: San Antonio Corporation manufacturers a part for

Q69: Sound tactical decision making<br>A)only concerns the short