Multiple Choice

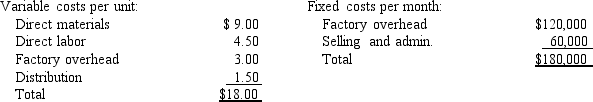

Modesto Company produces CD Players for home stereo units. The CD Players are sold to retail stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores. The current production and sales volume is

The variable distribution costs are for transportation to the retail stores. The current production and sales volume is

20,000 per year. Capacity is 25,000 units per year.

A San Diego wholesaler has proposed to place a special one-time order of 10,000 units at a reduced price of $24 per unit. The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of $3,000. All other information remains the same as the original data. What is the effect on profits if the special order is accepted?

A) increase of $12,000

B) increase of $57,000

C) increase of $75,000

D) decrease of $168,000

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Albatross Products had the following unit costs:

Q13: Cellestial Manufacturing Company produces Products A1, B2,

Q16: Zildjian Corporation manufactures a single product with

Q18: A decision to make a component internally

Q41: If a firm is at full capacity,

Q47: The following three situations are given for

Q73: In a keep-or-drop decision, the _ income

Q74: Which of the following is NOT a

Q91: Which of the following is NOT a

Q111: The cost of acquiring activity capacity is