Multiple Choice

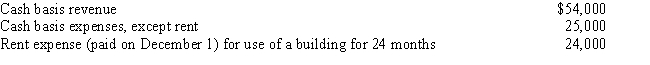

Becky is a cash basis taxpayer with the following transactions during her calendar tax year: What is the amount of Becky's taxable income from her business for this tax year?

A) $7,000 loss

B) $11,000

C) $27,500

D) $28,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Which of the following is not an

Q32: Quince Corporation changes its year-end from a

Q34: Goodwill is considered to be a Section

Q35: On May 2,2017,Scott purchased a commercial building.The

Q38: Amy is a calendar year taxpayer reporting

Q41: Steve Corp bought a $600,000 apartment building

Q47: If a corporation has a short tax

Q48: Choose the correct statement.<br>A)Residential real property is

Q75: Routine maintenance costs for capital assets are

Q101: To be depreciated, must an asset actually