Essay

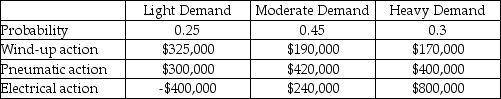

A toy manufacturer has three different mechanisms that can be installed in a doll that it sells.The different mechanisms have three different setup costs (overheads)and variable costs and,therefore,the profit from the dolls is dependent on the volume of sales.The anticipated payoffs are as follows.

a.What is the EMV of each decision alternative?

a.What is the EMV of each decision alternative?

b.Which action should be selected?

c.What is the expected value with perfect information?

d.What is the expected value of perfect information?

Correct Answer:

Verified

(a)Wind-up = .25($325,000)+ .45($190,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: If a decision maker knows for sure

Q18: Which of the following is NOT considered

Q33: Earl Shell owns his own Sno-Cone business

Q36: Define expected monetary value (EMV).

Q38: What is the EMV for Option 2

Q38: A do-it-yourself homeowner is installing a new

Q68: A retailer is deciding how many units

Q68: What is the difference between the expected

Q88: A square node on a decision tree

Q91: A state of nature is an occurrence