Multiple Choice

Table 6.4

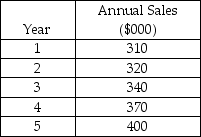

Mr.Lee is considering a capacity expansion for his supermarket.The annual sales projected for the next five years follow.The current capacity is equivalent to $300,000 sales.Assume a 20 percent pretax profit margin.

-Using the information in Table 6.4,if Lee expands the capacity to an equivalent of $360,000 sales now (year 0) ,and then expands the capacity to an equivalent of $400,000 sales at the beginning of year 4,how much would pretax cash flow increase in total for all years (years 1 through 5) ?

A) less than $30,000

B) more than $30,000 but less than $40,000

C) more than $40,000 but less than $50,000

D) more than $50,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Table 6.3<br>The North Bend Manufacturing Company is

Q12: Table 6.1<br>The Union Manufacturing Company is producing

Q15: A lumber mill is capable of producing

Q25: Capacity can be expressed by output or

Q34: Diseconomies of scale is a concept that

Q38: Give four principal reasons economies of scale

Q40: Capacity cushions may be lowered if companies

Q46: Regarding the measurement of capacity, when a

Q62: _ are more appropriate measures of capacity

Q114: Extremely complex service capacity problems for which