Multiple Choice

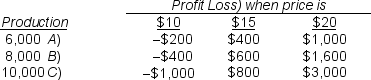

A firm making production plans believes there is a 30% probability the price will be $10,a 50% probability the price will be $15,and a 20% probability the price will be $20.The manager must decide whether to produce 6,000 units of output A) ,8,000 units B) or 10,000 units C) .The following table shows 9 possible outcomes depending on the output chosen and the actual price.  What is the expected profit if 10,000 units are produced?

What is the expected profit if 10,000 units are produced?

A) $500

B) $700

C) $625

D) $1,000

E) $1,754

Correct Answer:

Verified

Correct Answer:

Verified

Q21: A firm is considering two projects,A and

Q22: Use the following two probability distributions for

Q23: making decisions under risk<br>A)maximizing expected value is

Q24: A firm is considering two projects,A and

Q26: The manager's utility function for profit

Q27: exists when<br>A)all possible outcomes are known but

Q28: A firm is considering two projects,A and

Q29: The following payoff matrix shows the various

Q30: A firm is making production plans for

Q57: Using the minimax regret rule the manager