Multiple Choice

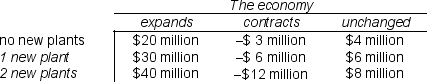

A firm is considering the decision of investing in new plants.The following is the profit payoff matrix under three conditions: it does not expand,it builds two new plants,or it builds one new plant.Three possible states of nature can exist--no change in the economy,the economy contracts and the economy grows.The firm has no idea of the probability of each state.  What decision would be made using the maximum expected value rule?

What decision would be made using the maximum expected value rule?

A) no new plants

B) one new plant

C) two new plants

D) not enough information to tell

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Subjective probabilities are<br>A)determined from actual data on

Q34: Refer to the following table showing the

Q35: maximin rule<br>A)ignores bad outcomes.<br>B)is used by optimistic

Q37: Use the following two probability distributions for

Q38: A firm making production plans believes there

Q41: Refer to the following table showing the

Q42: A firm is considering two projects,A and

Q43: A probability distribution<br>A)is a way of dealing

Q43: A firm is considering two projects,A and

Q44: A firm is considering the decision of