Multiple Choice

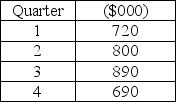

George P.Burdell owns a hot tub store that is experiencing significant growth.Burdell is trying to decide whether to expand the store's capacity,which currently is at $750,000 in sales per quarter.He is thinking about expanding to the $850,000 level.The before-tax profit from additional sales is 20 percent.Sales are seasonal,with peaks in the spring and summer quarters.Forecasts of capacity requirements,expressed in ($000) sales per quarter,for next year (year 2) are:  Demand in year 3 and beyond is expected to exceed $850,000 per quarter.Burdell is considering expansion at the end of the fourth quarter of this year (year 1) .How much would before-tax profits in year 2 increase because of this expansion?

Demand in year 3 and beyond is expected to exceed $850,000 per quarter.Burdell is considering expansion at the end of the fourth quarter of this year (year 1) .How much would before-tax profits in year 2 increase because of this expansion?

A) less than $28,000

B) more than $28,000 but less than $32,000

C) more than $32,000 but less than $36,000

D) more than $36,000

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Regarding the measurement of capacity, when a

Q56: Input measures include such metrics as:<br>A) the

Q73: Scenario 4.5<br>The T. H. King Company has

Q75: The seven-person maintenance function at a hospital

Q78: John Owen owns a drugstore that is

Q82: The Union Manufacturing Company is producing two

Q84: One of the many steps in the

Q109: If demand is increasing, and you also

Q115: A larger capacity cushion may be required

Q119: An expansionist capacity strategy:<br>A) lags behind demand.<br>B)