Essay

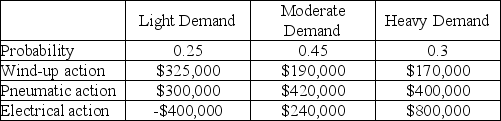

A toy manufacturer has three different mechanisms that can be installed in a doll that it sells.The different mechanisms have three different setup costs (overheads)and variable costs and,therefore,the profit from the dolls is dependent on the volume of sales.The anticipated payoffs are as follows.

a.What is the EMV of each decision alternative?

a.What is the EMV of each decision alternative?

b.Which action should be selected?

c.What is the expected value with perfect information?

d.What is the expected value of perfect information?

Correct Answer:

Verified

(a)Wind-up = .25 ∗ $325,000 + .45 ∗ $190...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: A primary advantage of decision trees compared

Q11: What is the EMV for Option 1

Q12: What is the EMV for Option 1

Q15: What is the EMV for Option 2

Q17: _ is the expected payout or value

Q19: The campus bookstore sells stadium blankets embroidered

Q20: Miles is considering buying a new pickup

Q51: In a decision tree,the expected monetary values

Q59: A problem that involves a sequence of

Q77: The last step in the analytic decision