Essay

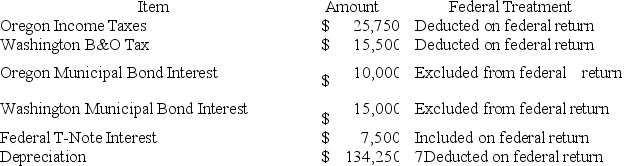

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Moss' Oregon depreciation was $145,500. Moss' Federal Taxable Income was $549,743. Calculate Moss' Oregon state tax base.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: List the steps necessary to determine an

Q3: Handsome Rob provides transportation services in several

Q24: Big Company and Little Company are both

Q28: State tax law is comprised solely of

Q48: Sales personnel investigating a potential customer's creditworthiness

Q66: Which of the following is incorrect regarding

Q69: Which of the following statements regarding income

Q92: The Quill decision reaffirmed that out-of-state businesses

Q103: Nondomiciliary businesses are subject to tax everywhere

Q120: Businesses engaged in interstate commerce are subject