Essay

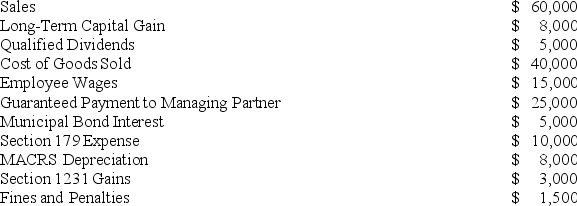

Illuminating Light Partnership had the following revenues, expenses, gains, losses, and distributions:

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Given these items, what is Illuminating Light's ordinary business income (loss) for the year?

Correct Answer:

Verified

($28,000),...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: If a partner participates in partnership activities

Q5: Does adjusting a partner's basis for tax-exempt

Q9: A partner's tax basis or at-risk amount

Q53: In what order should the tests to

Q62: For partnership tax years ending after December

Q82: Which of the following statements exemplifies the

Q83: Zinc, LP was formed on August 1,

Q92: Which of the following items are subject

Q94: Which of the following items will affect

Q102: Sarah, Sue, and AS Inc. formed a