Essay

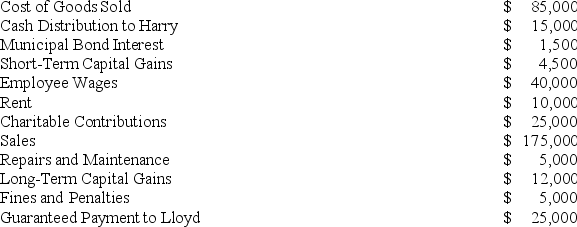

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount of ordinary busines...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: If partnership debt is reduced and a

Q26: On 12/31/X4, Zoom, LLC reported a $60,000

Q28: Guaranteed payments are included in the calculation

Q36: Under proposed regulations issued by the Treasury

Q41: In each of the independent scenarios below,

Q57: Actual or deemed cash distributions in excess

Q86: On March 15, 20X9, Troy, Peter, and

Q87: For partnership tax years ending after December

Q98: How does additional debt or relief of

Q103: XYZ, LLC has several individual and corporate