Essay

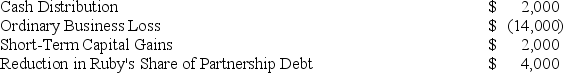

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at risk amount are equal and that she is a material participant in the partnership's activities.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at risk amount are equal and that she is a material participant in the partnership's activities.

Correct Answer:

Verified

As shown in the table below, Ruby must f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: In what order are the loss limitations

Q9: On March 15, 20X9, Troy, Peter, and

Q13: Jerry, a partner with 30% capital and

Q15: Jay has a tax basis of $14,000

Q17: J&J, LLC was in its third year

Q61: Fred has a 45% profits interest and

Q76: Styling Shoes, LLC filed its 20X8 Form

Q88: This year, HPLC, LLC was formed by

Q96: What is the difference between a partner's

Q114: Partners must generally treat the value of