Essay

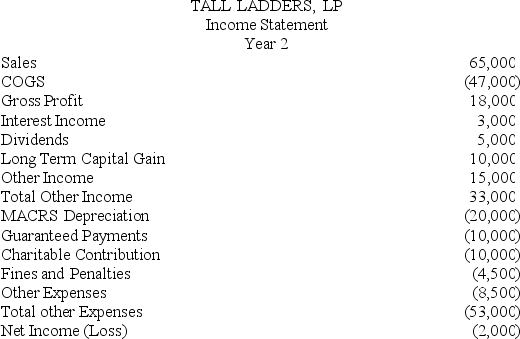

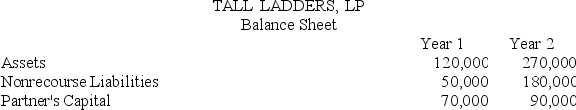

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Correct Answer:

Verified

Tony's adjusted basis at the e...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Kim received a 1/3 profits and capital

Q4: Bob is a general partner in Fresh

Q23: Jordan, Inc., Bird, Inc., Ewing, Inc., and

Q49: Income earned by flow-through entities is usually

Q50: Hilary had an outside basis in LTL

Q53: A general partner's share of ordinary business

Q64: Tim, a real estate investor, Ken, a

Q86: John, a limited partner of Candy Apple,

Q87: What general accounting methods may be used

Q92: A purchased partnership interest has a holding