Essay

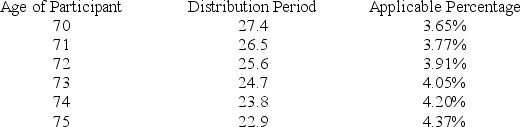

Sean (age 74 at end of 2018) retired five years ago. The balance in his 401(k) account on December 31, 2017 was $1,700,000 and the balance in his account on December 31, 2018 was $1,750,000. In 2018, Sean received a distribution of $50,000 from his 401(k) account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Correct Answer:

Verified

$26,800 remaining after taxes and penalt...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: High-income taxpayers are not allowed to receive

Q30: When an employer matches an employee's contribution

Q77: Which of the following describes a defined

Q82: Keisha (50 years of age) is considering

Q84: Gordon is a 52-year-old self-employed contractor (no

Q85: Joan recently started her career with PDEK

Q86: Heidi retired from GE (her employer)at age

Q87: This year, Ryan contributed 10 percent of

Q88: Kathy is 48 years of age and

Q91: Sean (age 74 at end of 2018)