Multiple Choice

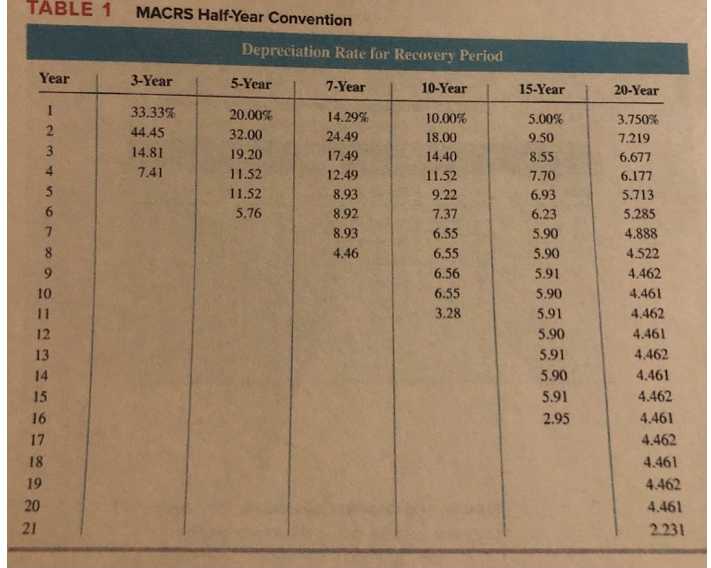

-Littman LLC placed in service on July 29,2018 machinery and equipment (7-year property) with a basis of $600,000.Littman's income for the current year before any depreciation expense was $100,000.Which of the following statements is true to maximize Littman's total depreciation expense for 2018? (Use MACRS Table 1)

A) Littman should take §179 expense equal to the maximum $1,000,000.

B) Littman should take no §179 expense.

C) Littman's §179 expense will be greater than $100,000.

D) Littman's §179 expense will be less than $100,000.

E) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Paulman incurred $55,000 of research and experimental

Q24: During August of the prior year, Julio

Q25: Billie Bob purchased a used camera (5-year

Q29: Alexandra purchased a $55,000 automobile during 2018.

Q35: Suvi, Inc. purchased two assets during the

Q57: Simmons LLC purchased an office building and

Q58: PC Mine purchased a platinum deposit for

Q78: Lenter LLC placed in service on April

Q99: Depletion is the method taxpayers use to

Q122: Which is not an allowable method under