Essay

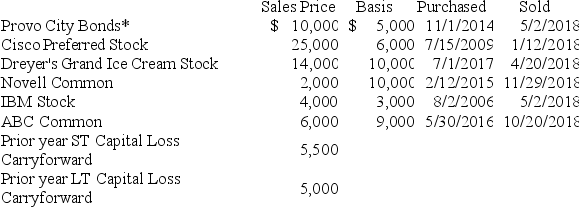

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City

*Purchased when originally issued by Provo City

What is the Net Short-Term Capital Gain/Loss reported on the 2018 Schedule D? What is the Net Long-Term Capital Gain/Loss reported on the 2018 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Correct Answer:

Verified

$1,500 net short-term capital loss is re...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: When a taxable bond is issued at

Q15: Michelle is an active participant in the

Q18: Bob Brain files a single tax return

Q22: On January 1, 20X8, Jill contributed $18,000

Q25: Assume that Joe (single) has a marginal

Q27: Compare and contrast how interest income is

Q28: In the current year, Norris, an individual,

Q29: When electing to include preferentially taxed capital

Q39: Losses associated with personal-use assets, sales to

Q82: The rental real estate exception favors:<br>A)lower-income taxpayers