Essay

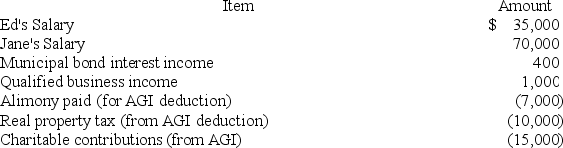

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's gross income?

Correct Answer:

Verified

$106,000, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Which of the following statements is true?<br>A)Income

Q35: Itemized deductions and the standard deduction are

Q41: The relationship test for qualifying relative requires

Q60: Jasmine and her husband Arty have been

Q65: The standard deduction amount for married filing

Q65: An individual receiving $5,000 of tax-exempt income

Q73: In June of year 1,Eric's wife Savannah

Q83: Jennifer and Stephan are married at year-end

Q106: Bonnie and Ernie file a joint return.Bonnie

Q107: If an unmarried taxpayer iseligible to claim