Essay

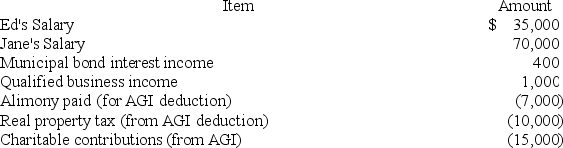

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's taxable income?

Correct Answer:

Verified

$73,800, s...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Greg is single.During 2018,he received $60,000 of

Q11: All of the following are for AGI

Q37: Which of the following is not an

Q61: Char and Russ Dasrup have one daughter,Siera,who

Q73: Which of the following statements regardingdependents is

Q78: The Dashwoods have calculated their taxable income

Q100: When determining whether a child meets the

Q110: In 2018,Brittany,who is single,cares for her father

Q114: Which of the following statements regarding dependents

Q118: Filing status determines all of the following