Essay

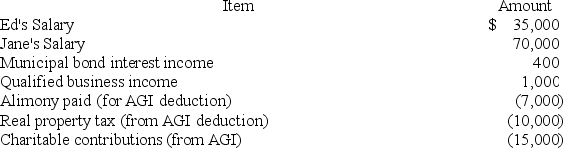

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

Correct Answer:

Verified

$675 tax d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: If a taxpayer does not provide more

Q13: Inventory is a capital asset.

Q30: Which of the following statements regarding exclusions

Q36: Tom Suzuki's tax liability for the year

Q50: Jeremy and Annie are married. During the

Q68: In June of year 1,Jake's wife Darla

Q94: In order to be a qualifying relative

Q101: Which of the following statements regarding for

Q117: In June of year 1,Edgar's wife Cathy

Q130: For AGI deductions are commonly referred to